Australian equities were strong in January. The rebound from the last few days of 2018 extended into the new year and ultimately into a 3.8% gain in the S&P/ASX 300 index. The MSCI world index was up 7.4%. A rebound after the turmoil of the fourth quarter is not that surprising, but the question is whether it’s sustainable. Gains were underpinned by a shift in sentiment on two of the key issues which weighed on markets in Q4 2018 – US Fed policy and Chinese economic growth.

In the US, there has been a material shift in rhetoric from the Fed, its now more dovish stance suggesting it is not as deaf to market feedback as many feared. We are still facing an environment of reduced liquidity, however investors are now less concerned that a sharp liquidity crunch could drive a more sustained correction.

On the other side of the Pacific, China has continued to unveil piecemeal stimulus measures in response to a decelerating economy. Among the most recent is the provision of credit backstops in the form of credit default swaps (CDS) which effectively address some bank concerns and encourage lending. This serves as a reminder that Beijing does have several levers it can pull to maintain reasonable economic growth, without having to resort to the relatively blunt tool of property stimulus. That said, the trade dispute remains simmering and is still a source of risk.

While the Australian mining sector is ultimately driven by Chinese demand, it was developments in Brazil which saw a 22% increase in iron ore in January. A disastrous collapse in a tailings dam has seen Vale announce that it will close ~40m tonnes of production, equating to about 10% of its annual production. Beyond the short-term squeeze in iron ore markets, this could have more profound consequences as mines around the world review tailing dams constructed along the same lines as the one which failed so tragically at Corrego de Feijao.

A collapsing oil price also weighed on markets in late 2018 and here, too, we have seen a recovery, with the price up 17% as OPEC cuts begin to bite and fears of a major global slowdown recede. Oil companies form a significant part of global corporate credit markets and an improvement in the oil price has relieved some pressure here and seen corporate credit spreads narrow, signalling more confidence.

In sum, an improvement in sentiment on these key issues has been reflected in better equity prices. In a domestic context, uncertainty persists around the outlook for bank lending and the potential for a credit slowdown to drag on the economy. This week’s recommendations from the Royal Commission are likely to provide more direction here. We think underlying economic conditions remain reasonable and that the Commission is unlikely to suggest anything which would have a major effect on the banking system’s ability to lend money.

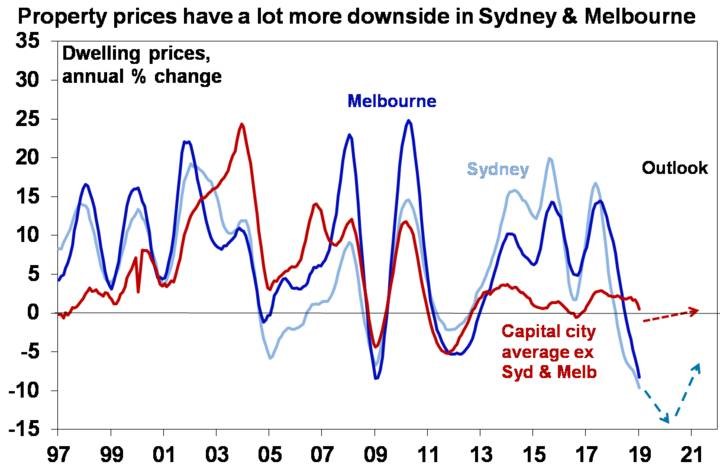

Meanwhile, CoreLogic data showed a further sharp fall in dwelling prices in January with national capital city prices now down 7.8% from their September 2017 high which is more severe than their fall in the GFC. Sydney prices have now seen their biggest fall since the early 1980s recession. Tight credit, rising supply, falling foreign demand and falling prices feeding on themselves have combined to create a perfect storm for Sydney and Melbourne, with Perth and Darwin still falling and most other cities pretty soft. We see Sydney and Melbourne home prices falling another 15% or so this year as part of a total top to bottom fall of 25%, which with little change in average prices across other cities will see national average home prices fall another 5 to 10% this year.

Global shares are likely to see volatility remain high with the high risk of a re-test of December 2018 lows, but valuations are now improved, and reasonable growth and profits should support decent gains through 2019 as a whole helped by more policy stimulus in China and Europe and the Fed pausing.

Australian shares are likely to do okay but with returns constrained by moderate earnings growth.

Low yields are likely to see low returns from bonds, but they continue to provide an excellent portfolio diversifier.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.