All indices ended April in the positive, with equities leading the way again, continuing their upward trend as economic optimism remains high. Volatility fell in April, with the VIX finishing the month slightly up – but at a mere 18, it remains the lowest it has been since February 2020. With these calmer waters, the S&P/ASX200 Accumulation Index finished the month 3.47% higher and the MSCI World index in $Au was also 3.0% higher.

On the domestic front, there has been cause for mild worry as WA endured snap lockdowns following a string of local transmissions. There has also been a global slowdown in the rollout of the vaccine. Offshore, major concern is forming around India as cases and deaths ramp up. Employment and core inflation continues to be of primary concern to the RBA, as the soaring housing market keeps being largely ignored during RBA speak. Monthly housing price changes in major cities are increasing at rates well above annual inflation. Yet, the RBA Governor Philip Lowe has again in April reaffirmed that there is no intention to raise interest rates until at least 2024. Lowe cites wage growth as the key indicator for sustainable inflation growth. Bond markets are pricing in higher inflation premised on expectations of stronger economic growth across the board – not just wage growth. Domestically the federal government flagged that the Budget would continue to be expansionary, with no desire to tap the brakes yet. Spending is likely to be highly targeted, including a focus on social outcomes. This is in line with a shift in thinking evident in other Western governments.

Inflation is on the rise globally, but it is likely to be a confusing picture over the next few years, against the backdrop of a likely bottoming of the long-term decline in inflation seen over the last forty years. This will see headline inflation measures spike higher in the months ahead – probably towards 4% or more in the US (and in Australia too albeit less so in Europe and Japan). With this will come the risk of a renewed bond market tantrum as investors worry that central banks will not be able to control inflation. Even so, inflation is likely to fall back again. This partly explains why central banks are reluctant to rush into rate hikes at present. The likely fall back in inflation later this year combined with central banks remaining dovish will mean that any near-term bond market panic and hit to share markets are likely to be short lived.

Longer term though it is likely we are now going through the bottoming of the long-term decline in inflation that has been in place since the early 1980s as bigger government and ultra-easy central banks focused on pushing unemployment as low as it can go to get inflation up. This is ultimately what central banks are aiming for and they naturally worry that if they raise rates prematurely in response to what will likely be a short-term inflation spike in the next few months, they will just risk a downturn in 2022 which will set back their longer-term desire to get inflation up and further damage their credibility. Albeit this will take several years to play out and the question is whether it results in inflation ultimately averaging around target or something higher. Our base case is the former, although the risks are possibly swinging to the latter.

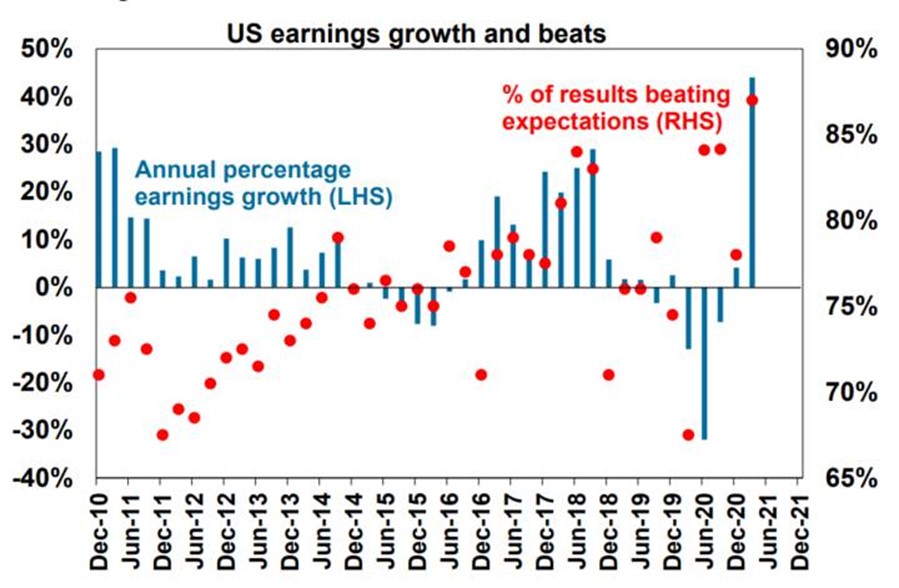

The US March quarter earnings reporting season has remained very strong and is now nearly 90% complete. 87% of companies have beaten earnings expectations by an average +23% and 71% have beaten revenue expectations. Consensus earnings expectations for the quarter have now risen to +48% year on year, from +21% three weeks ago. Tech sector earnings are up 43%, but consumer discretionary is up 186%, financials are up 137% and materials are up 61%.

Source: Bloomberg, AMP Capital

Australian data remained strong with booming home prices, housing finance and approvals along with very strong PMIs, surging job ads, a sharp jump in vehicle sales and the MI Inflation Gauge showing a pick-up in inflation pressure.

Our view remains that share markets will head even higher this year as recovery continues, this boost earnings and monetary policy remains easy, albeit with some tapering in bond buying along the way. However, investor sentiment is very bullish which is negative from a contrarian perspective and we are coming into a seasonally softer period of the year for shares. A resumption of the bond tantrum as US inflation rises further in the months ahead, US tax hike concerns if Congress does not pare back some of Biden’s tax hikes, coronavirus setbacks and geopolitical risks (around US/China tensions, Russia and Iran) could all provide a trigger for a correction. It would likely be just another correction though. The combination of improving global growth and earnings helped by more stimulus, vaccines and still low interest rates augurs well for shares over the next 12 months.

Australian home prices are likely to rise another 15% or so over the next 18 months being boosted by record low mortgage rates, economic recovery and FOMO, but expect a slowing in the pace of gains as government home buyer incentives are cut back, fixed mortgage rates rise, macro prudential tightening kicks in and immigration remains down relative to normal.

Cash and bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.1%.