In August markets made strong gains with the ASX 200 rising by 2.83% and the MSCI All Country World Index NR gaining 2.91%.

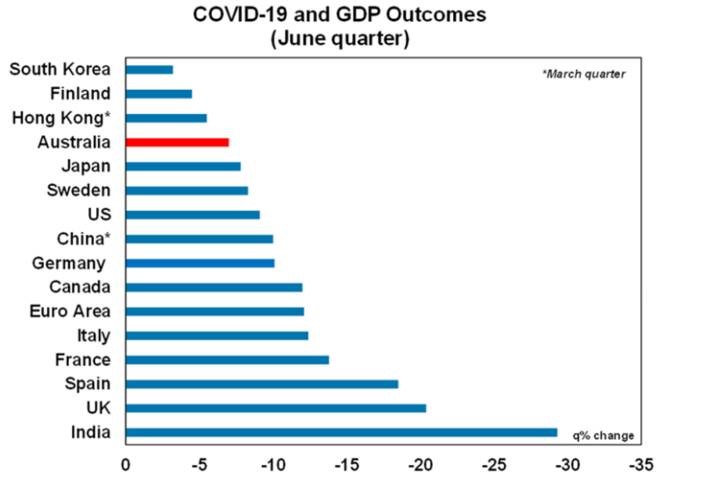

Australian GDP fell by 7% in the June quarter, which was worse than the latest market expectations but better than had been expected around April when many were forecasting a 10% or so decline. This is the worst quarterly decline on record (the quarterly data only goes back to 1959). But annual GDP growth has declined to 6.3% which looks to be the worst since 1930-31 which saw financial year GDP fall by 9.4%. Australia has fared relatively well in the June quarter downturn compared to other countries around the world (see chart below) which all had various levels of lockdowns or restrictions.

Source: Bloomberg, AMP Capital

However, given the stricter lockdown in Melbourne since early August and the other restrictions across the rest of Victoria, the outlook for GDP growth in the September quarter is for another negative quarter of growth (albeit a much smaller decline than the June quarter) whereas growth in a lot of other global counterparts (like the US) looks to be in a cyclical upswing as low interest rates and government fiscal stimulus boost economic growth. After this low point in Australian GDP (which we think will be the September quarter), there will be a need to fill the growth pothole left by the COVID-19 pandemic, so the pressure will remain on the Reserve Bank and Federal and state governments to provide additional support to the economy. Federally this is likely to come in the form of a bring forward of tax cuts and tax incentives to boost consumption and investment possibly in next month’s budget.

The last financial year in Australia has seen the biggest earnings slump since the early 1990s recession, but it’s not been as bad as feared. The Australian June half profit reporting season is pretty much done, with 92% of companies having reported accounting for 99% of market capitalisation. Company earnings and dividends have been hit hard by the coronavirus shock. Only 36% of companies have seen earnings rise from a year ago compared to a norm of 66% and a whopping 55% cut their dividends compared to a norm of just 16%, which attests to the severity of the hit to earnings and the uncertainty around the outlook

Financials have been hit the hardest, with the consensus now expecting a -30.9% slump in their earnings led by insurers and the banks, followed by industrials with a -17.8% fall in earnings and resources with -14.7%. Consumer discretionary stocks are the only sector to have seen a rise in earnings (+10.4%), as they benefitted from “at home” spending on furnishings and office equipment.

US data was mostly improved. Consumer confidence fell to its lowest since 2014, but home sales and durable goods orders surged again in July, while personal spending rose more than expected, indicating there is a sizeable bunch of Americans who want to get out and spend. Personal income also rose more than expected and while the savings rate fell, it is still very high (at 17.8%), which will provide ongoing support for spending if confidence improves. Reflecting the rebound in home building indicators, the US lumber price is up more than 300% from its crisis low. Jobless claims also continue to trend down.

Eurozone economic confidence and German & French business conditions and confidence readings improved in August.

After a strong rally from March lows shares remain vulnerable to short term setbacks given uncertainties around coronavirus, economic recovery, the US election and US/China tensions. But on a 6 to 12-month view shares are expected to see good total returns helped by a pick-up in economic activity and stimulus.

Unlisted commercial property and infrastructure are ultimately likely to continue benefitting from a resumption of the search for yield but the hit to economic activity and hence rents from the virus will weigh heavily on near term returns.

Australian home prices at present are being protected by income support measures and bank payment holidays but higher unemployment, a stop to immigration and rent holidays will push prices lower into next year. Home prices are expected to fall by around 10%-15% from their April high. Melbourne is particularly at risk on this front as its Stage 4 lockdown pushes more businesses and households to the brink.

Cash & bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.25%.

Source: AMP Capital.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.