The S&P/ASX 200 index gained +0.6% in August, despite the political instability experienced during the month. Scott Morrison was appointed Prime Minister, replacing Malcolm Turnbull. This caused some short-term weakness in equities, but the index recovered its losses within a matter of days. This highlights the resilience of the equity market to politics given how little scope there has been for significant structural reform in the past.

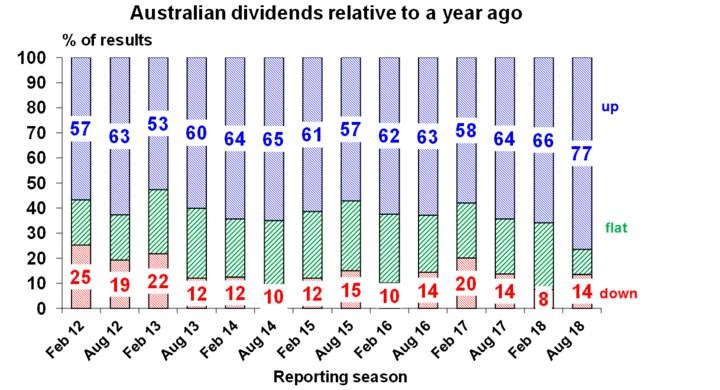

The June half Australian earnings reporting season is now wrapped up and results have been solid, but not spectacular. 44% of results have surprised on the upside, which is in line with the long-term norm, the breadth of profit increases was impressive with 77% reporting higher profits than a year ago which is the strongest since before the GFC and compares to a norm of 66%. 86% have increased their dividends or held them constant and 62% of companies have seen their share price outperform the market on the day results were released. 2017-18 earnings growth have come in around expectations at about 8%, with resources earnings up 25% thanks to solid commodity prices and rising volumes and the rest of the market seeing profit growth of around 5% with bank profits seeing a 2% fall but strong profit gains for insurers, health care, gaming and utility stocks. It’s not the 28% earnings growth being seen in the US but it’s still solid. Key themes have been continuing strong dividend payments, some pressure from higher raw material costs, outperformance by high quality offshore exposed companies and softer than expected guidance. Profit growth this financial year is expected to slow to around 5% as the growth in resource profits slows further.

.jpg)

.jpg)

Source: AMP Capital

Trade issues between the United States and China continue to escalate with Donald Trump indicating that the 10% tariff imposed on $200bn of imports from China could be increased to 25%. This would have a more meaningful effect on the US consumer. China announced a 25% tariff on a further $16bn of US imports including fuel and steel products, in an equally measured response to the US finalising $16bn of tariffs on imports from China. Risk sentiment turned positive in the second half of the month with a trade agreement being reached between the United States and Mexico.

This helped the S&P 500 (+3.0%) and the Nasdaq (+5.7%) hit record highs. Most sectors in the S&P 500 closed the month in the black except for Energy (-3.8%) and Materials (-0.7%). The greatest gains came from Information Technology (+6.7%), Consumer Discretionary (+5.0%) and Health Care (+4.2%). Central bankers converged on Jackson Hole in Wyoming for the annual economic policy symposium, at which, concerns were expressed around the imposition of trade tariffs on foreign imports, and the effects these may have on inflation. US Federal Reserve Chair, Jerome Powell, presented the opening remarks during which he indicated that the Fed is not seeing a clear sign of inflation accelerating above 2%, “and there does not seem to be an elevated risk of overheating”. These comments sent the US dollar briefly lower on the assumption that the Fed’s monetary policy tightening path won’t diverge (accelerate) from what has been indicated. The market has priced in the next interest rate hike for September, which would take the federal funds rate to 2.00-2.25%.

We continue to see share markets being higher by year end, as global growth remains solid helping drive good earnings growth and monetary policy remains easy. However, we are now into a seasonally weak period of the year for share markets and rising threats around trade and emerging market contagion at a time of ongoing Fed rate hikes, the Mueller inquiry in the US, the US mid-term elections and Italian budget negotiations point to a period of increased volatility and potential weakness ahead. Property price weakness and election uncertainty add to the risks in relation to the Australian share market.

National capital city residential property prices are expected to slow further with Sydney and Melbourne property prices likely to fall another 10% or so, but Perth and Darwin property prices bottoming out, and Adelaide, Canberra and Brisbane seeing moderate gains.

Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.2%.

We continue to see the A$ trending down to around US$0.70 as the gap between the RBA’s cash rate and the US Fed Funds rate pushes further into negative territory as the US economy booms relative to Australia. Solid bulk commodity prices should provide a floor for the A$ though in the high US$0.60s. Being short the A$ remains a good hedge against things going wrong in the global economy.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.