The S&P/ASX 200 index fell 1.26% in September whilst the MSCI World Index (Au) rose by 0.51%. Since the start of this month we have seen a significant decline in World share markets.

Since the start of this month we have seen a significant decline in World share markets. Since October 1, equities are down 10% in the Chinese onshore market, 6% in the U.S. and Europe, and 5% in Australia. The recent correction has not been as severe as the one in February and the VIX index has not spiked as high, but this doesn’t make it any less painful. A busy political and corporate calendar over the coming weeks could keep markets on edge, but we expect equities to eventually find their footing given still positive earnings outlook and economic momentum globally. A timely reminder to investors of the importance of rebalancing and diversifying as the cycle ends.

We think that the recent decline can be boiled down to the combination of three factors. The first and most important cause is the market’s increased focus on tightening liquidity, with Chair Powell stating that the US Fed benchmark rate is a “long way from neutral,” suggesting further rate rises to come as inflationary pressures build within the US economy. This notion proved a particular headwind for the growth stocks, with many of the market’s recent leaders in the tech and health care sectors among the worst performers last week.

The second issue came with several US companies pre-announcing results and revealing higher input costs are starting to have an impact on their outlook. This raised concerns of decelerating earnings following a strong upgrade cycle. This is an issue which has already raised its head in Australia, where a weaker AUD pushed up input costs in the last reporting season. While the upcoming earnings season will serve as an important barometer on the state of the US cycle, at this point we think we may have seen the worst of the input cost effect in the pre-season confessions.

Finally, there are also a number of signs of softness emerging in the Chinese consumer space, such as data suggesting that the auto sector is facing its first year-on-year decline in sales for the first time in almost thirty years. With Golden Week consumption not as strong as hoped, last weekend’s cut in the reserve requirement ratio (RRR) is being interpreted as a response to subdued consumer demand, rather than pre-emptive stimulus to offset trade sanctions. On the trade front, the Trump Administration’s aggressive rhetoric continued last week and we see little sign of this relenting before the meeting between Presidents Trump and Xi in November.

We do not think last week’s move marks the beginning of an equity bear market. That said, we think there is a good chance of more near term volatility. We last saw a similar drop in February, followed by a swift bounce back. However this time we think people are making a more material adjustment in their thinking with regard to tightening liquidity and what this means for the market and, in particular, the growth names. We doubt it’s the start of a major bear market because history tells us that they invariably require a US recession and with US monetary conditions still far from tight, fiscal stimulus still impacting and no signs of the excess (in terms of overinvestment, debt growth, etc) that normally precedes a recession, a US recession still looks a long way off. In turn, suggests that the trend in earnings and hence share markets is likely to remain up, beyond the near-term pull back.

Looking out from here, the Australian market remains relatively defensive given that a significant proportion of it has already been significantly discounted (Financials) or has reasonable earnings support (Resources). This is in contrast to markets like the US which has a larger proportion of highly-rated growth stocks. Nevertheless, it was the defensives which outperformed on the ASX in the midst of last week’s volatility, with REITS only down -2.6%, while Financials (-4.9%) and Resources (-5.0%) underperformed. The latter’s move was driven in part by weakness in oil after a strong run.

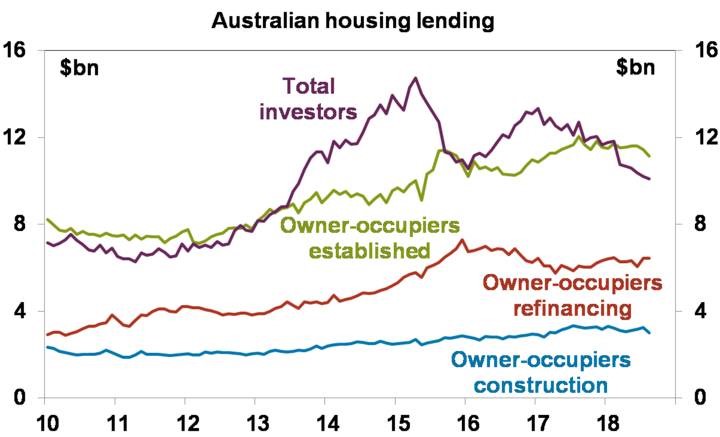

On the housing front Australian business and consumer confidence rose slightly in September and October respectively, but both are well down on recent highs. Meanwhile, although housing starts fell in the June quarter consistent with a peaking in housing construction activity, work yet to be done is at a record high, three times above where it was in 2009 and telling us that there is still a lot of supply about to hit the softening homebuyer market. Housing finance also continued to slide. All of which is consistent with ongoing falls in home prices.

Source: ABS, AMP Capital

Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.2%.

While the A$ has now fallen close to our target of US$0.70 it likely still has more downside into the US$0.60s, as the gap between the RBA’s cash rate and the US Fed Funds rate pushes further into negative territory as the US economy booms relative to Australia. Being short the A$ remains a good hedge against things going wrong in the global economy.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.