In May markets continued their strong rebound with the ASX 200 rising by 4.3% and the MSCI world Au. rising 3.4%.

US data was generally better than expected. While construction spending fell more than expected in April, the ISM manufacturing and non-manufacturing conditions indexes improved in May, PMIs for May were revised to show a slightly stronger gain, the ADP employment survey showed a much smaller than expected fall in May and initial jobless claims continued to fall. All of which is consistent with the US economy having likely passed the low point.

Eurozone business conditions PMIs were also revised up to show a slightly stronger gain in May.

China’s business conditions PMIs generally improved further in May and after a plunge in February have now traced out a deep V recovery consistent with other indicators pointing to recovery in the Chinese economy.

Australian economic data provided no surprises. GDP fell 0.3% in the March quarter which was in line with expectations and reflected falls in consumer spending on services, dwelling and business investment and stockpiles more than offsetting contributions to growth from public spending and net exports. Retail sales were also confirmed to have plunged in April, the trade surplus fell on the back of a fall back in exports and building approvals fell albeit by less than expected but with more falls likely on the way as the local government approval process catches up to the impact of the coronavirus shock. The June quarter will almost certainly see a huge plunge in economic activity reflecting the severity of the lockdown in April confirming that Australia has been in recession.

CoreLogic average home price data showed a -0.5% fall for capital cities in May as the coronavirus shock started to impact, with falls in five of the eight capital cities. Significant policy support and the earlier reopening of the economy have cushioned falls. However, our base case is for home prices to fall around 5-10%, as “true” unemployment will remain high, government job and income support measures and the bank payment holiday end in September, immigration falls and new supply is likely to be boosted marginally via the Homebuilder scheme.

There were no surprises with the RBA leaving monetary policy on hold and retaining a very dovish bias for the third month in a row. Surprisingly there was no mention by the RBA of the rebound in the value of the Australian dollar which is now around $US0.70. This is where it was earlier this year and well up from around $US0.55 at the height of the coronavirus driven financial market panic in March. The rebound likely reflects a combination of “risk on” that sees the Australian dollar move up with shares and perceptions that the Australian economy is doing better than the US economy.

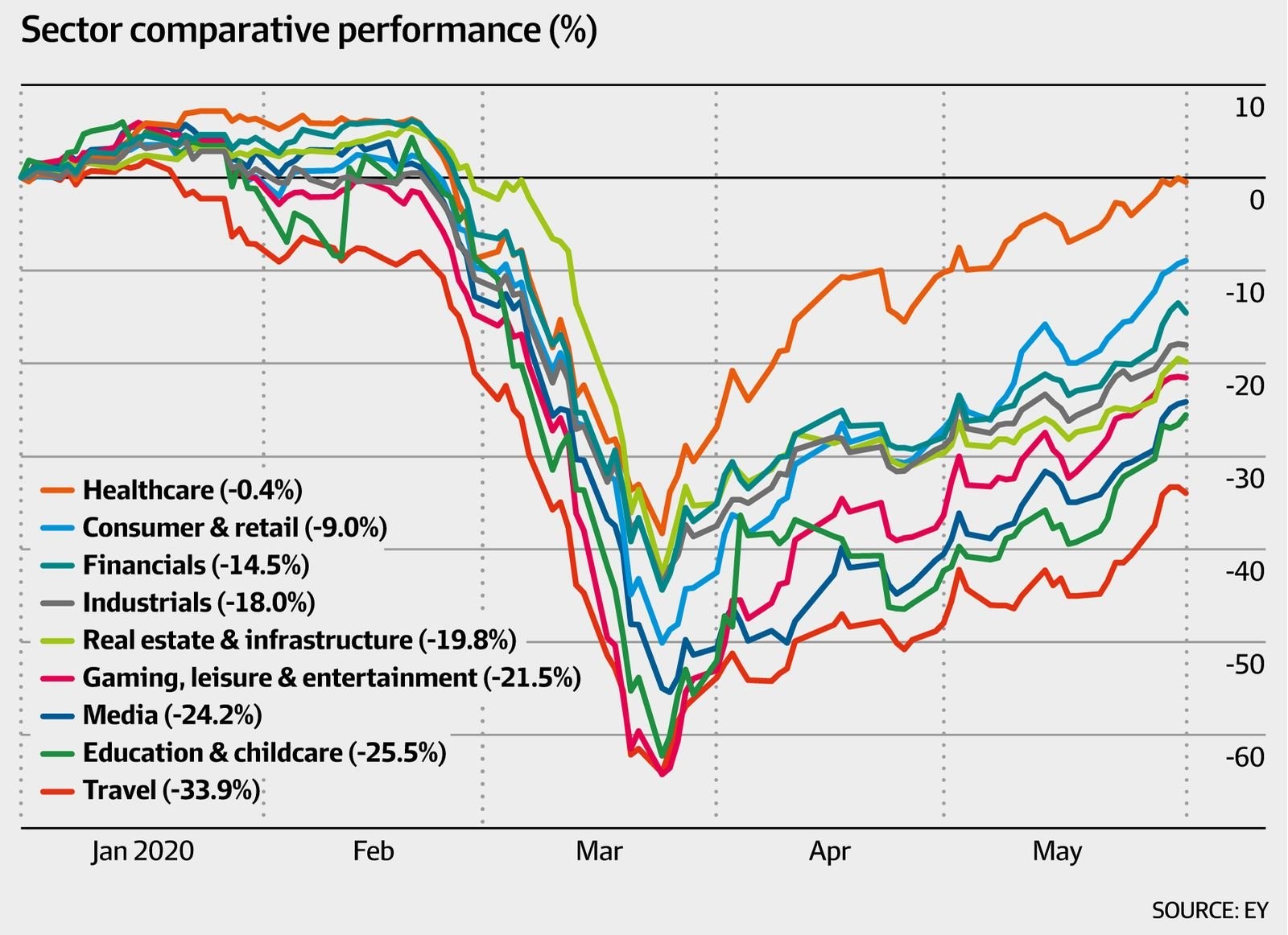

I found this graph from the Financial Review interesting, as it shows the recovery in share prices for different sectors.

After a strong rally from March lows and uncertainties around coronavirus, economic recovery and US/China tensions shares are vulnerable to short term setbacks. But on a 12-month horizon shares are expected to see good total returns helped by a pick-up in economic activity and massive policy stimulus.

Low starting point yields are likely to result in low returns from bonds once the dust settles from coronavirus.

Cash & bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.25%.

Source: ABS, AMP Capital.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.