October saw the continuation of the downward trend in share markets with the ASX 300 down - 4% and the MSCI World $AU down -1%. The first week of November has seen some of these losses recovered as markets rallied.

The Fed has likely finished raising rates. As widely expected, the Fed left its Fed Funds rate on hold at 5.25-5.5%. While Fed Chair Powell indicated that the Fed is still not confident it has done enough and that it could still hike again, he also noted that the Fed is now “proceeding carefully”, acknowledged again that the rise in bond yields has tightened financial conditions and noted that the risks are “more two sided now”. Of course, this does not mean that the Fed has relaxed its higher for longer message on rates. It’s still determined to get inflation down to target and conscious that the rise in bond yields over the last six months may reflect expectations of higher for longer policy rates, so it may still have to sound tough for a while otherwise it risks seeing the financial tightening from higher bond yields reverse before it wants it too (as we have seen a bit in the last week). The bottom line is that as long as growth slows after the surge last quarter and inflation continues to fall then it’s likely that the Fed is at the top. Slowing October jobs and wages growth are consistent with this.

In Australia the new Governor Michele Bullock handed down her first rate hike lifting the interest rate from 4.1% to 4.35% at the Reserve Bank of Australia’s (RBA) November meeting, as broadly expected by the market. However, the statement released by the RBA was dovish, which surprised the market. The board acknowledged in the statement that the cumulative interest rate raises are flowing through to the economy, albeit more slowly than expected, as evidenced by negative real incomes and weakening consumption growth. The RBA reiterated the importance of controlling inflation and stated that it will continue to take a data-dependent approach.

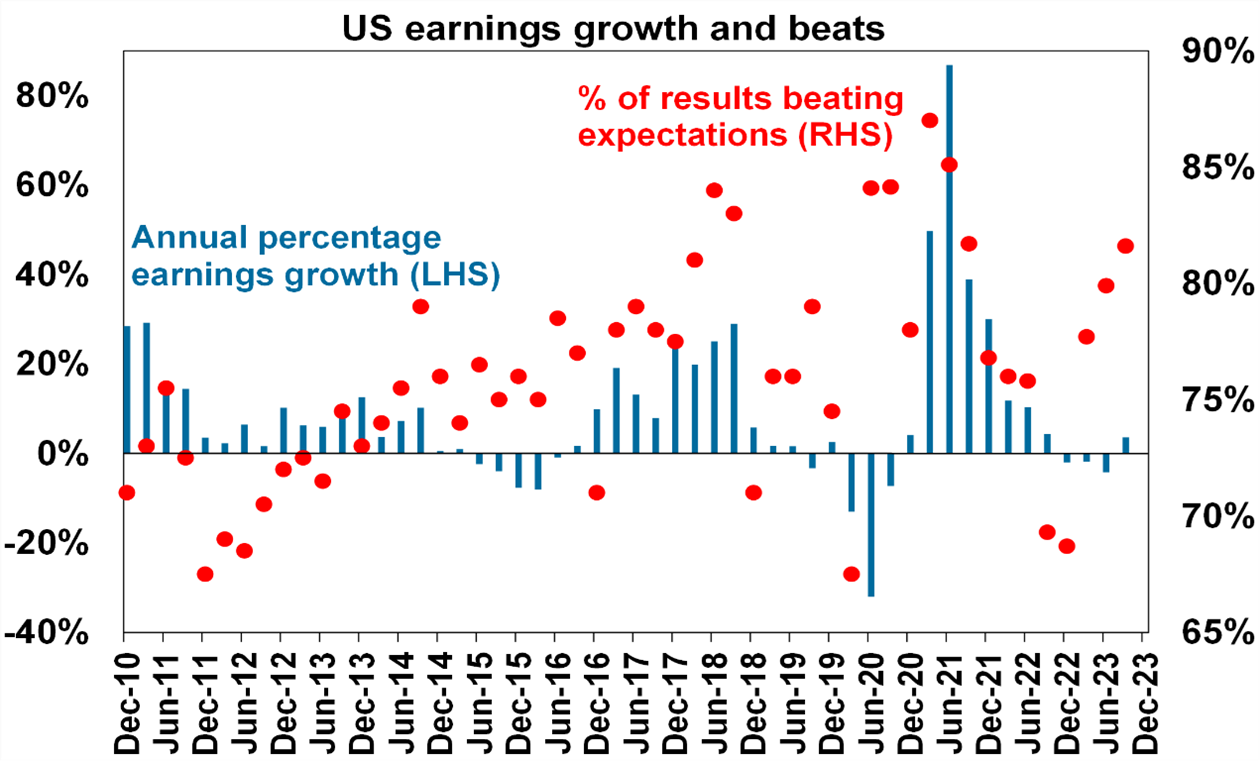

US earnings beats strongest in two years. 81% of US S&P 500 companies have now reported September quarter earnings with 81.9% beating expectations, well above the norm of 76% and the strongest in 2 years. Earnings growth for the quarter has improved to +3.6% YoY from +0.6% at the start of the reporting season. This is positive, but we do note that analysts have been reducing estimates for Q4 earnings much faster than the long-term averages and possibly at the fastest pace since Q220.

Source AMP, Bloomberg.

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of higher for longer rates from central banks, high bond yields which have led to poor valuations and the risk that the war in Israel escalates to include significant oil producing countries like Iran.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to remain negative as “work from home” continues to hit space demand as leases expire.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Source: AMP Capital, Pendal, AZ Sestante