Markets ended fairly flat in January with the ASX 200 rising 0.3% and International markets down -0.4% as represented by the MSCI World Index in Australian Dollars.

After a 3% to 4% pull back at the end of January share markets have yet again been buoyed in February by more good news – around economic data, earnings, declining Covid cases, vaccines, and stimulus. The vulnerability to a renewed short-term pullback remains but the broader trend likely remains up, as it is too early to expect a cyclical bull market top. Against this backdrop it will likely remain hard to time corrections.

In Australia, the RBA remains ultra-dovish and focussed on getting inflation sustainably up. As widely expected, the RBA left interest rates on hold at its February meeting, but it surprised by announcing an extension to its bond buying program and indicated that it does not expect to raise rates before 2024 at the earliest.

The run of strong Australian economic data releases largely continued over the last week, with strong business conditions PMIs, record levels for housing finance driven by owner occupiers and first home buyers and finance for new construction, another surge in building approvals driven by approvals for houses, continuing solid gains in house prices albeit with Sydney and Melbourne lagging, a further rise in ANZ job ads and a continuing strong recovery in payroll jobs after adjusting for seasonality. ABS final retail sales data confirmed a -4.1% decline in December retail sales as strong Black Friday sales brought spending forward and the Covid scare in late December impacted. But this followed several exceptionally strong months, they are up a whopping 9.6% year on year and they rose a stronger than expected 2.5% in real terms in the December quarter. And the trade surplus rebounded in December, albeit by less than expected.

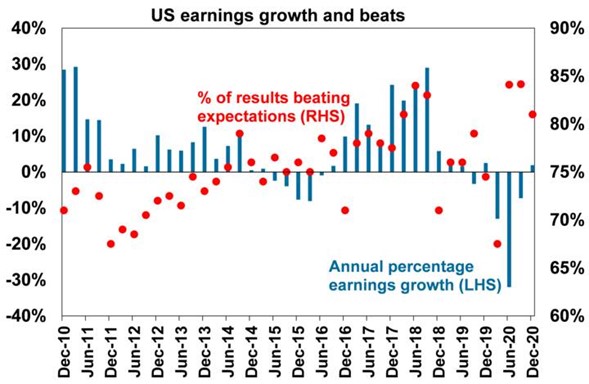

US earnings are back to around pre coronavirus levels. The US December earnings reporting season is now about 58% complete, with results remaining strong. 81% of companies have so far surprised on the upside (compared to a norm of 75%) by an average 19% and 75% have beaten on revenue. As a result, consensus earnings expectations have been revised up to +2% year on year which is up from -9%yoy two weeks ago. In other words, earnings are likely now above pre coronavirus levels.

We have entered a period where there are two competing investment themes. One is that continual government stimulus and low interest rates will continue to support equity markets and drive prices higher. Conversely competing with this is the fact that many valuations for assets are extremely high. There is plenty of worried commentary about the risk in equities given the recent strong run, it is worth reiterating the extraordinary moves in fundamentals we think continue to support markets:

- In the US, money supply (M2) is up 26% year-on-year

- The combined balance sheets of the Fed and ECB are up 70% year-on-year

- US fiscal stimulus, as measured by the budget deficit, is up US$2 trillion year-on-year

- Global short interest rate yields are down by 100bps to 0.65% year-on-year.

Macro risk and uncertainty remain elevated. Equity markets have had a strong run. Nevertheless, we think the combination of these effects is extraordinary and continues to provide a substantial foundation for both economic recovery and equity markets. We remain positive. We expect bond yields to rise, coinciding with a rotation to cyclicals.

Shares remain at risk of a short-term correction after having run up so hard recently and 2021 is likely to see a few rough patches along the way. But timing such moves will be hard and looking through the inevitable short-term noise, the combination of improving global growth helped by more stimulus, vaccines and low interest rates augurs well for growth assets generally in 2021.

We are likely to see a continuing shift in performance away from investments that benefitted from the pandemic and lockdowns - like US shares, technology and health care stocks and bonds - to investments that will benefit from recovery - like resources, industrials, tourism stocks and financials.

Global shares are expected to return around 8% but expect a rotation away from growth heavy US shares to more cyclical markets in Europe, Japan and emerging countries.

Australian home prices are likely to rise another 5% or so this year being boosted by record low mortgage rates, government home buyer incentives, income support measures and bank payment holidays but the stop to immigration and weak rental markets will likely weigh on inner city areas and units in Melbourne and Sydney. Outer suburbs, houses, smaller cities and regional areas will see relatively stronger gains in 2021.

Cash and bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.10%.

Source: AMP Capital, Pendal Group.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.