Equity markets were weak during March with the Australian ASX 200 down about 4% and International markets were down 2.4% (MSCI world $US).

The initial market response to President Trump’s proposed tariffs on China was an overreaction with US shares losing US$1.4 trillion in market capitalisation in response to maybe less than US$50 billion in tariffs on a tiny fraction of global trade, when the US will see something like US$800 billion in fiscal stimulus this year. Just as the US/Korea free trade deal was renegotiated (with relatively minor concessions to the US) despite Trump threatening to terminate it, our view remains that China and the US will reach a negotiated solution, both in terms of trade and investment restrictions, such that the tariffs and restrictions will ultimately be very modest, if at all. But this could take a while to resolve, and so market nervousness around this issue will linger for a while.

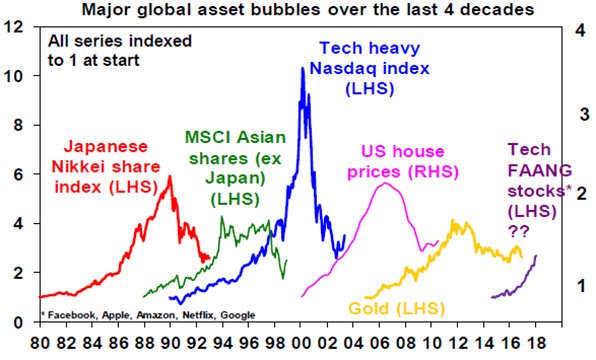

Technology stocks saw volatility over the month, led by Facebook on the back of its privacy violation along with worries about a broader regulatory response for e-commerce stocks and concerns the Trump Administration will limit Chinese investment into technology stocks. Technology stocks have been at the forefront of the US bull market and some worry that a bubble in FAANG stocks has come to an end. Tech shares have certainly had a long run-up and have been a key beneficiary of quantitative easing. As such they are vulnerable to a likely tightening in regulation and quantitative tightening, however, while the run- up in FAANG stocks in recent years does look a bit bubbly, it’s nowhere near the scale of the late 1990s tech boom – see the next chart.

Source: Bloomberg, AMP Capital

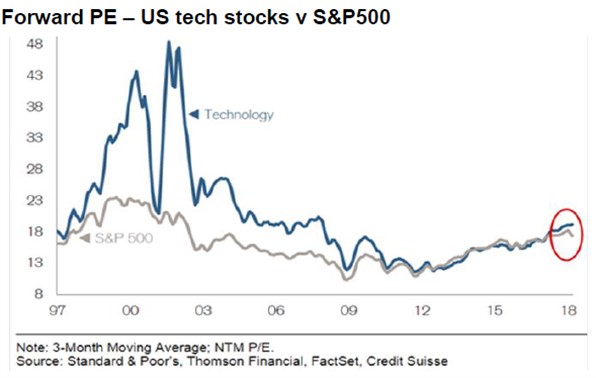

And the forward Price-to-Earnings (PE) on technology stocks today is well below what it was at the height of the tech bubble and has been more in line with that of the overall market.

In Australia, the Reserve Bank of Australia (Tuesday) is likely to leave rates on hold for the 20th month in a row, which will surpass the previous record of 19 months on hold which was set between January 1995 and July 1996. High business confidence, strong jobs growth and the RBA's own growth and inflation forecasts argue against a rate cut, but risks around consumer spending, weak wages growth and inflation, the slowing Sydney and Melbourne property markets and the still too high A$ argue against a rate hike. We don’t see the RBA commencing a tightening cycle until first half 2019 and an emerging further tightening in bank lending standards around home borrower income and expenses along with any flow-through to higher mortgage rates from the recent increase in short term funding costs could delay this.

Meanwhile on the data front in Australia, expect: CoreLogic data for March to show continuing flat to slightly falling home prices (Tuesday); a 12% or so fall in building approvals in February after a 17% spike in January and a 0.3% gain in February retail sales (both due Wednesday); and a February trade surplus of around $900 million (Thursday). Business conditions PMIs for March are likely to remain solid.

Volatility in share markets is likely to remain high and further weakness is possible as US inflation and interest rates move up and as issues around President Trump and trade continue to impact, particularly ahead of the US mid-term elections in November, but the medium-term trend in share markets is likely to remain up as global recession is unlikely and earnings growth remains strong globally and solid in Australia.

National capital city residential property price gains are expected to slow to around zero as the air continues to come out of the Sydney and Melbourne property boom and prices fall by around 5%, but Perth and Darwin bottom out, Adelaide and Brisbane see moderate gains and Hobart booms.

Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.2%.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.