Markets around the world deteriorated dramatically over the month of March with the international escalation of the coronavirus crisis. The Australian share market was down 21% and the MSCI World Au was down 9% helped to a large degree by the decline in the Australian dollar.

Coronavirus concerns continued to create volatility in investment markets over the past week, but the good news is that it remains both up and down volatility on a day to day basis as opposed to straight down as was the case up until a couple of weeks ago. US, European and Japanese shares gave up some of their gains from the previous week, but Chinese and Australian shares rose, with the Australian share market playing a bit of catchup and getting a boost from the Australian Government’s massive wage subsidy program. Bond yields fell in the US, UK, Japan and Australia but they rose in Europe. Commodity prices were mixed with a surge in oil prices (albeit only to $US25/barrel) on President Trump’s talk of Saudi Arabia and Russia cutting production. Copper prices rose, but the iron ore price fell. The $A fell back towards $US0.60 as the $US headed higher again.

Whist the number of coronavirus cases globally continues to escalate policy stimulus continues to ramp up dramatically, which is helping tip the risks away from coronavirus shutdowns driving a long and extended recession/depression. Notably in the last week:

•Having signed off on one $US2 trillion package Trump and Congress are now talking of another similar sized package focused on jobs and infrastructure.

•China announced more monetary easing and looks set to do more fiscal stimulus amounting to around 5% of GDP.

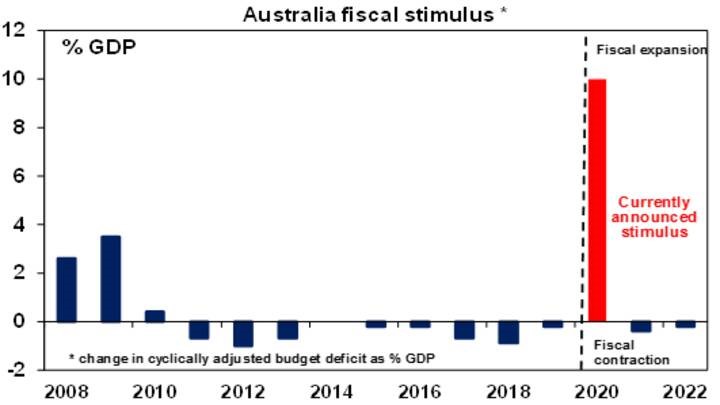

•The Australian Government announced a third fiscal support package centred on a wage subsidy for around 6 million workers costing $130bn over six months bringing total fiscal stimulus to be pumped into the economy in the year ahead to just over $200bn or 10% of GDP (see the next chart). The wage subsidy program will help businesses, help workers and help keep unemployment down and so is a very good move. It also announced a support package for the childcare industry and Australia has moved to a rent relief program for individuals and business tenants.

Source: IMF, AMP Capital

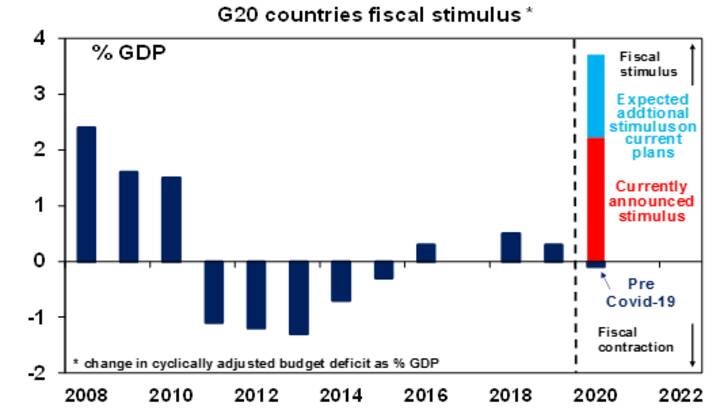

There have now been more than 270 stimulus announcements around the world. Central banks and governments appear to remain committed to doing “whatever it takes” to limit the economic impact on the economy and ensure a decent recovery (although a laggard remains the EU where a joint response to fiscal support is lacking leaving the ECB to fill the void). The next chart shows our estimate of global fiscal stimulus as a share of GDP for this year. If currently proposed measures are allowed for its going to be nearly 4% of global GDP and far greater than that seen in the GFC.

Source: IMF, AMP Capital

Policy support will help minimise the downside and boost the recovery, but we still need to see evidence the virus and its economic impact will come under control before we can be confident shares have bottomed.

Key things to watch for in the short term for a sustained bottom in markets remain: signs that the number of new coronavirus cases is peaking – there has been good news in China, South Korea, Italy and maybe even here in Australia but the US still looks a few weeks away from peaking and it drives the direction of share markets; the successful deployment of anti-virals – there are positive signs but it still looks like a way to go; signs that corporate and household stress is being successfully kept to a minimum – too early to tell; signs that market liquidity is being maintained and supported as appropriate by authorities – this has improved; “blood in the streets” – investor panic is already evident but it can always get worse; technical signs of a market bottom like a loss of selling momentum and an inverse “head and shoulders” pattern – the strong rally in the last two weeks is reminiscent of rallies in October/November 2008 that signalled the start of a bottoming process albeit the market did not finally bottom until March 2009; and lots of policy stimulus to minimise the fall-out from shutdowns – this gets a tick albeit we may need more.

Shares are vulnerable to further short-term falls given the uncertainty around the coronavirus both in terms of the outbreak’s duration and its economic impact. But on a 12-month horizon shares are expected to see good total returns helped by an eventual pick-up in economic activity and policy stimulus.

The Australian housing market is now weakening rapidly in response to coronavirus. Social distancing will mean a collapse in sales volumes and a sharp rise in unemployment, a stop to immigration through the shutdown and rent holidays pose a major threat to property prices. Prices are expected to fall between 5% to 20%, but government support measures including wage subsidies along with bank mortgage payment deferrals along with a plunge in listings will help limit falls at least for the next six months.

Cash & bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.25%.

The deepening hit to global growth from Covid-19 and its flow on to reduced demand for Australian exports and lower commodity prices still risks pushing the $A lower in the short term possibly to a re-test of its low two weeks ago of $US0.55 or even its 2001 low of $US 0.477 as a worst case. But expect a strong rebound once the threat from coronavirus recedes.

At Farrow Hughes Mulcahy we continue to monitor all of these developments and how they are affecting our clients’ portfolios and investments in what is an ever-changing scenario. We are all working diligently to ensure the long-term success of our client’s investment strategies. Should you have any questions or simply wish to discuss the current situation please do not hesitate to contact your adviser.