In September markets were generally lower with the ASX 200 declining by approx. -3.66% and the MSCI World $US down approx. -0.38%.

While global shares have had a bit of a bounce over the last week led by the US it remains too early to say the correction is over – seasonal weakness often continues into October, coronavirus could worsen into the northern winter, another round of US fiscal stimulus is now looking less likely until after the election and the US election is likely to add to volatility. However, we remain of the view that it’s just a correction after an excessive run up in US shares and not the start of a renewed bear market and that a continued but gradual and messy recovery along with ultra-easy monetary policy will underpin a rising trend in shares on a 6-12 month horizon, providing coronavirus is controlled.

News that President Trump has tested positive for coronavirus and will quarantine just adds to the short-term uncertainty, even though it is unlikely to change the policy outlook. It may raise concerns though that the election will be delayed, particularly if Joe Biden also tests positive, thereby prolonging the uncertainty for investors. It is unlikely to have any long-term implications though so investors should just stick to their long-term investment strategy.

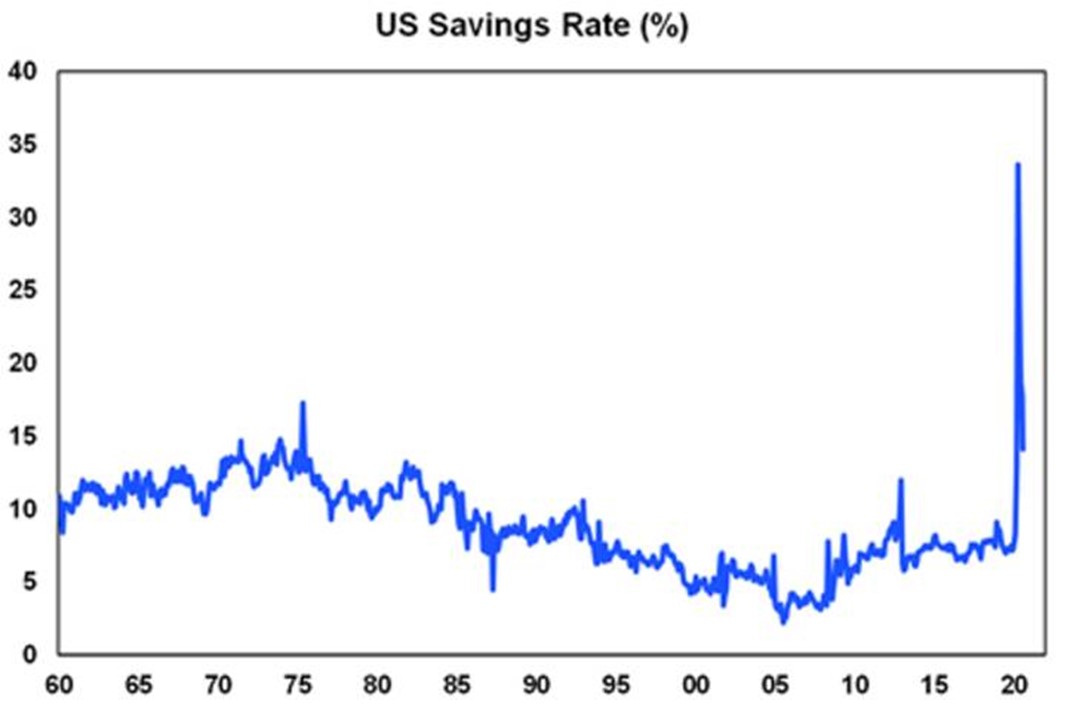

US data remained strong over the past week. Consumer confidence is up, pending home sales surging in August with strong home price gains, construction spending up, jobless claims falling and August personal spending seeing a solid gain despite a fall in income on the back of reduced unemployment benefits with households drawing down the saving rate. The still high personal saving rate of 14% suggests that this will remain a source of support for spending going forward providing confidence improves.

Source: US BEA, AMP Capital

The US remains on track for an initial deep V recovery with the Atlanta Fed’s GDP now pointing to a 9% rebound in September quarter GDP based on already released data after a 9% June quarter contraction.

Australian data was mixed with a decline in building approvals, very weak growth in credit but a surge in job vacancies over the three months to August that recovered 80% of the slump in May. The rebound in job vacancies is consistent with various private surveys and points to more job’s growth ahead. Home - Builder and various housing sector measures should help support building approvals in the months ahead despite the collapse in underlying demand associated with the crash in immigration. Final August retail sales confirmed a 4% decline mainly driven by Victoria but with most states down slightly as pent up demand had been used up and demand had been brought forward.

Meanwhile capital city home prices fell again in September, but the pace of decline has continued to slow, and six of the eight cities saw gains. Massive government income support measures and bank payment holidays explain why house prices have only fallen slightly over the last six months despite the biggest hit to the economy since the 1930s. But the artificial nature of the market also makes it hard to work out what this means for the future direction of prices. High unemployment, the collapse in immigration and the hit to the rental market point to more downside. But working against this are continuing government measures to support the property market – with the removal of responsible lending obligations and more measures likely in the Budget – on top of record low interest rates and more rate cuts also in prospect. Reflecting all these cross currents we continue to expect further declines in Victoria reflecting the bigger hit to its economy and maybe Sydney, but other cities seeing modest price gains. Reflecting the “work from home” phenomenon outer suburbs, regions and houses and likely to perform far better than inner city areas and units. The hit to immigration which will take many years to reverse will act as a constrain on medium term house price gains as will work from home which has given many people more flexibility as to where they live.

In Australia, the focus will be on the Government’s 2020-21 Budget on Tuesday which is expected to be big on spending and economic reforms all designed to spur demand and jobs. Reflecting another hit to revenue assumptions along with an extra $30bn in stimulus the budget deficit for this financial year is likely to be around $230bn (up from $184.5bn back in July). The key fiscal measures are expected to be:

•a bring forward of the July 2022 tax cuts to July 2020 or July 2021 (at a cost of around $15bn) and possibly the July 2024 tax cuts to July 2022;

•an investment tax break for all companies;

•an extra $10bn in infrastructure spending to state governments on a “use it or lose it” basis;

•a new wage subsidy tied to increased employment to replace JobKeeper;

•more support for the housing sector – probably via an extension of HomeBuilder and an expansion of the First Home Buyer Deposit scheme;

•$1.5bn in initial funding to help encourage manufacturing in six key areas;

•fringe benefits tax exemptions for businesses for e.g. retraining workers, supplying laptops & phones to workers;

•more health spending; and

•possibly more stimulus payments for welfare recipients.

More details around how the Government proposes to further its reform agenda around training and education, deregulation and industrial relations are also likely. The Government is also likely to affirm its commitment to not commence budget repair until unemployment is comfortably below 6% and to not raise taxes when it does so.

Just before the Budget on Tuesday the RBA meets with further monetary easing up for consideration. We expect more easing from the RBA for the simple reason that its forecast outlook for inflation and employment is not consistent with its objectives and it has highlighted regularly over the last month or so that its considering options for further easing. Our base case is that the RBA will cut the cash rate, the Term Funding Facility rate and the three year bond yield target to 0.1% on Tuesday so as to present a united “Team Australia” front with fiscal policy on the same day and thereby get a bigger impact.

Shares remain vulnerable to further short-term setbacks given uncertainties around coronavirus, economic recovery, the US election and US/China tensions. But on a 6 to 12-month view shares are expected to see good total returns helped by a pick-up in economic activity and stimulus.

Low starting point yields are likely to result in low returns from bonds once the dust settles from coronavirus.

Unlisted commercial property and infrastructure are ultimately likely to continue benefitting from a resumption of the search for yield but the hit to economic activity and hence rents from the virus will weigh heavily on near term returns.

Cash & bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.25%.

Source: AMP Capital.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.