Markets were mixed in October with the ASX 200 rising 1.9% and International markets down approx. -1.1% as represented by the MSCI World Index in Australian Dollars.

As had been well flagged, the RBA announced significant further monetary easing at its November meeting. This entails:

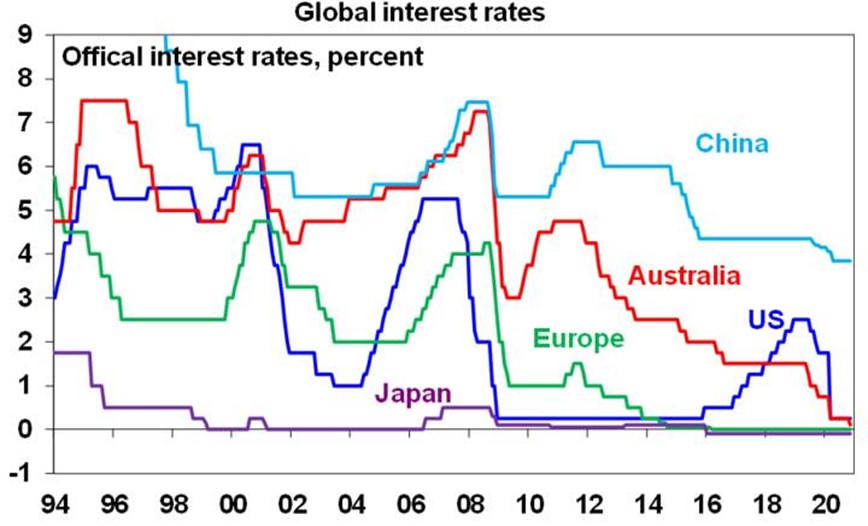

• A cut in the cash rate, the Term Funding Facility rate (i.e., the rate at which the RBA provides cheap funding to the banks for three years) and the three-year bond yield target to 0.10% (all from 0.25%). This takes the cash rate to a new record low. This leaves Australia’s official interest rate broadly consistent with rates in comparable countries around zero.

Source: Bloomberg, AMP Capital

Put simply, the RBA’s economic forecasts show that it does not expect to meet its inflation and employment objectives over the next two years and it sees the recovery as being bumpy and drawn out. It has been undershooting its 2-3 percent inflation objective for the last five years now.

More importantly the coronavirus hit to the economy has taken us further away from full employment and the RBA sees addressing the high rate of unemployment as an “important national priority.” Of course, fiscal policy is likely more powerful in terms of driving actual spending, but the RBA remains committed to do what it can and is under pressure to act when it’s not expecting to meet its objectives. It feels that monetary easing is likely to gain more traction now the economy is reopening and can’t ignore the faster pace of quantitative easing in other major countries. The latter has the effect of pushing up the $A relative to what it otherwise would be which in turn slows the economic recovery.

There are a number of implications for investors from the latest easing by the RBA. First, ultra-low interest rates will likely be with us for several more years, keeping bank deposit rates unattractive so it is important for investors in bank deposits to assess alternative options. Second, the low interest rate environment means the chase for yield is likely to continue supporting assets offering relatively high sustainable yields. This is likely to include Australian shares where despite sharp cuts to dividends, the grossed-up for franking credits dividend yield on shares remains far superior to the now even lower yield on bank term deposits. Investors need to consider what is most important – getting a decent income flow from their investment or absolute stability in the capital value of that investment. Of course, the equation will turn less favourable if economic activity deteriorates again.

The US election race remains close, making it hard to call. The tightening will likely weigh on shares as it implies an increased risk of a contested election. and less chance of substantial post-election fiscal stimulus to the extent that a “blue wave” that sees the Democrats win the presidency, control of the Senate and the House seems unlikely.

So far around 64% of US S&P 500 companies have reported September quarter earnings with 85% surprising on the upside regarding earnings (compared to a norm of 75%) and 77% surprising on the upside regarding revenue. Consensus earnings growth expectations for the quarter have been revised up from a fall of -21%yoy to -11%yoy and this is now likely to end up at around -8%yoy.

Shares remain vulnerable to further short-term volatility given uncertainties around coronavirus, economic recovery, and the US election. But on a 6 to 12-month view shares are expected to see good total returns helped by a pick-up in economic activity and stimulus.

Low starting point yields are likely to result in low returns from bonds once the dust settles from coronavirus.

Unlisted commercial property and infrastructure are ultimately likely to benefit from a resumption of the search for yield but the hit to economic activity and hence rents from the virus will weigh heavily on near term returns.

Australian home prices at present are being protected by income support measures and bank payment holidays but higher unemployment, a stop to immigration and weak rental markets will push prices down by another 5% into next year. Melbourne is particularly at risk on this front as its Stage 4 lockdown has pushed more businesses and households to the brink. Smaller cities and regional areas are in much better shape.

Cash & bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.10%.

Source: AMP Capital.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.