2023 turned out to be a strong year for investors with shares and bonds rallying on the back of falling inflation, the anticipation of interest rate cuts in 2024 and better than feared economic growth. There were bumps along the way, but balanced super funds returned around 9.5%.

Despite lots of angst at the start of the year, 2023 turned out far better than feared. Key big picture themes of relevance for investors were:

1. Stronger than feared growth. Despite fears that recession was inevitable, on the back of multiple rate hikes and a rough reopening in China, it’s been avoided so far, including in Australia, helped by saving buffers, reopening boosts particularly to eating out and travel and some labour hoarding. Economic growth in 2023 looks to have been around 3% globally and around 1.9% in Australia which was helped by a population surge partly offsetting severe mortgage pain for some.

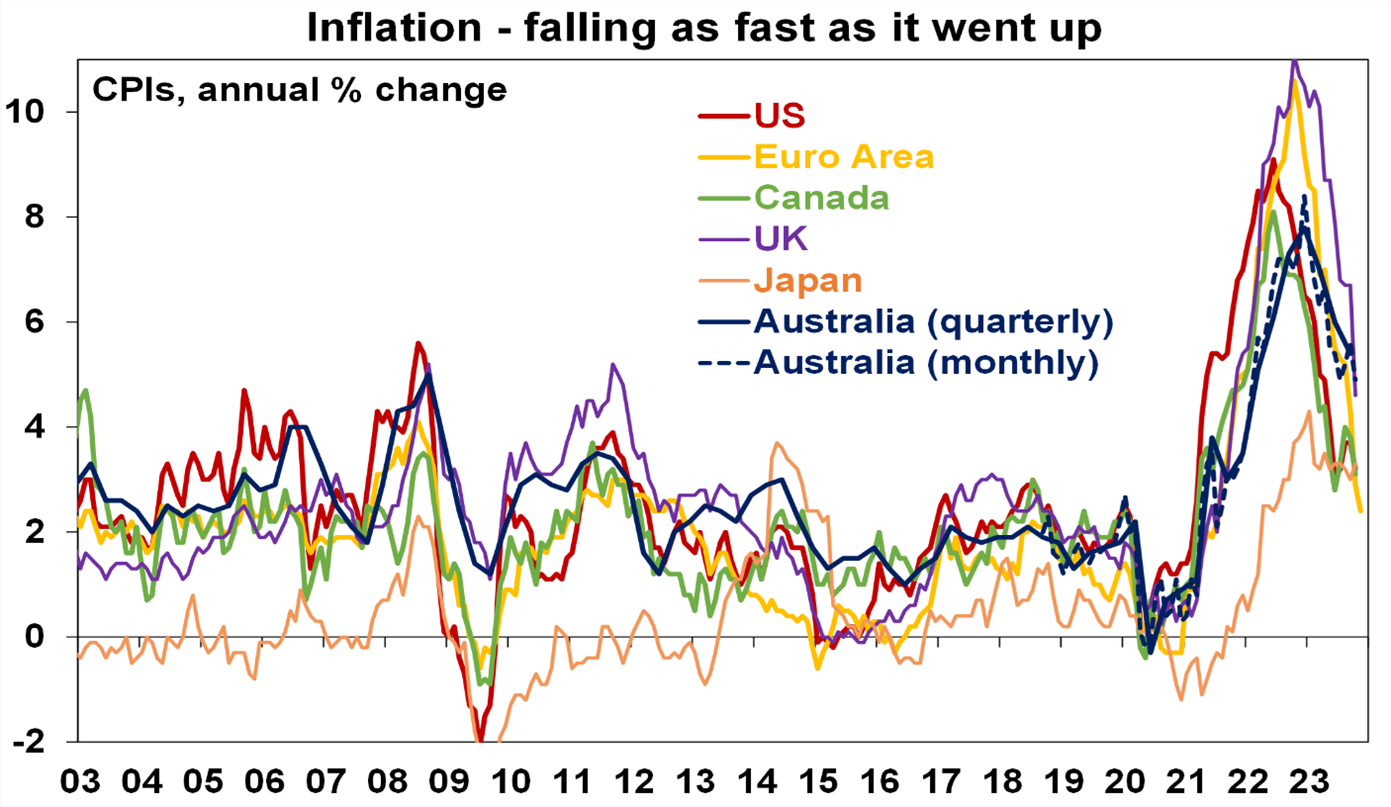

2. Disinflation. Inflation across major countries has fallen sharply from peaks of 8 to 11% last year to around 3 to 5%. Australia lagged on the way up and is doing the same on the way down, but it’s falling too.

Source: Bloomberg, AMP

3. Peak interest rates. It took longer to get there and there was a “high for longer” scare on rates but most major central bank policy rates look to have peaked and this probably includes the RBA’s cash rate.

4. Geopolitical threats proved not to be as worrying as feared – the war in Ukraine remained contained, conflict in Israel flared again but so far has not spread to key oil producers (oil prices actually fell a bit) & the Cold War with China thawed a bit. A lack of major elections helped.

5. Artificial intelligence hit the big time after the launch of Chat GPT with hopes it will boost productivity. The immediate beneficiaries were key (mostly US) tech stocks – which helped them reverse the 2022 slump.

Risks going in to 2024

The worry list remains long:

Inflation is still too high in most major countries – so central banks could still have another hawkish turn if it proves sticky above targets.

The risk of recession is high reflecting the lagged impact of rate hikes. It’s hard to see the biggest rate hiking cycle since the 1980s not having a major impact and the risks are already evident in tighter US lending standards, falling lending in Europe and stalling consumer spending in Australia. Unlike a year ago many are no longer worried about a recession which is negative from a contrarian perspective.

Risks around the Chinese economy and property sector remain high.

Geopolitical risk is high: with half the world’s population seeing 2024 elections including the US, the EU, India, Russia & South Africa; the US Government could have a shutdown starting 19 January & could have another divisive Biden v Trump presidential election with a Trump victory running the risk of weakening US democracy and US alliances and another trade war; the result of Taiwan’s 13 January election could see an easing or an escalation of tensions with China depending who wins; the war in Ukraine is continuing; and there is a high risk that the Israel/Hamas war could spread, eg to Iran, threatening oil supplies.

The recession risk suggests a high risk of a sharp pull back in shares.

Implications for investors

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay returns in 2024. However, with growth still slowing, shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession, it’s likely to be a rougher and more constrained ride than in 2023.

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts and lower bond yields and the anticipation of stronger growth later in the year and in 2025. Expect a slight outperformance by Asian and emerging market shares.

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to end 2024 at around 7,900 points.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields and working from home.

Australian home prices are likely to fall as high interest rates hit demand again and unemployment rises. The supply shortfall should prevent a sharper fall & expect a wide dispersion with prices still rising in Adelaide, Brisbane & Perth. Rate cuts later in the year will help.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed cutting rates more than the RBA.

Important note: While every care has been taken in the preparation of this document, Farrow Hughes Mulcahy make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Source: AMP Capital, Pendal, AZ Sestante